How I Slash Experience Costs Without Losing the Thrill

What if you could enjoy premium experiences—travel, dining, concerts—without draining your wallet? I’ve tested strategies that cut costs in half while keeping the joy intact. From smart timing to hidden memberships, it’s not about skipping fun, but redefining how you access it. This is real-life financial tuning: practical, proven, and totally doable. Let me show you how small shifts in spending habits can unlock big savings—without sacrificing what you love.

The Hidden Price of Living Fully

Many of us chase memorable experiences, believing they must come with high costs. But premium moments—fine dining, weekend getaways, live events—often carry inflated price tags built on impulse and convenience. I realized I was paying not for quality, but for positioning: where, when, and how I consumed. Understanding this shift—from what we buy to why and how—is the first step toward smarter spending. It’s not about denial; it’s about awareness. When you see experience inflation clearly, you gain power to reshape it.

Consider the weekend getaway. A two-night stay at a coastal resort during peak summer can cost over $800, while the same property in early spring may charge under $300. The room, view, and service remain nearly identical. The difference lies in demand, not quality. Similarly, a table at a popular downtown bistro on a Friday night costs significantly more than the same meal on a Tuesday evening—even if the ingredients and preparation are unchanged. These are not reflections of value but of behavioral pricing, where businesses capitalize on predictable patterns of desire and urgency.

Recognizing this allows you to separate emotional impulse from rational choice. The joy of travel isn’t in the date on the calendar; it’s in the walk along the shore, the taste of fresh seafood, the sound of waves at dusk. The thrill of a concert isn’t tied to the day of the week but to the music, the energy, the shared moment. Once you detach experience value from arbitrary timing or social pressure, you reclaim control. You begin to ask not “What do I want?” but “When and how can I get it best?” This subtle shift transforms spending from passive consumption to active strategy.

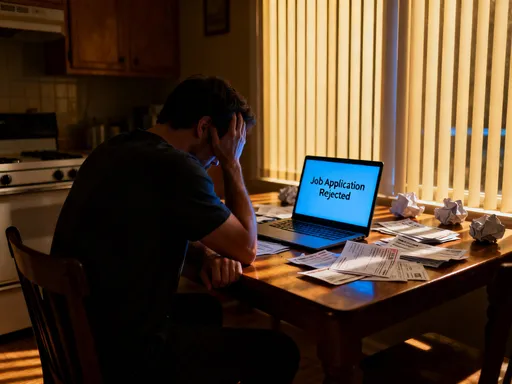

Moreover, many experience-based purchases are marketed as once-in-a-lifetime opportunities, triggering fear of missing out. Limited seating, exclusive access, and countdown timers are psychological tools designed to override careful decision-making. By stepping back and evaluating what you're actually paying for—beyond the hype—you avoid overpaying for manufactured scarcity. Awareness becomes your first line of defense against inflated costs. It doesn’t diminish the desire for rich, meaningful moments; it simply ensures those moments don’t come at an inflated price.

Timing Is Everything: When to Play and When to Wait

Experience costs swing wildly based on timing. A concert ticket can cost double on the event day. A beach resort triples its rates during peak season. I started tracking demand cycles—seasonal, weekly, even hourly—and adjusted my plans. Going out on Tuesdays instead of Fridays, booking weekend trips for shoulder months, or attending “last call” dining hours saved me consistently. The thrill didn’t fade; the value increased. Timing isn’t just a tactic—it’s a mindset shift from urgency to patience.

Seasonal timing is one of the most powerful levers. For travel, the difference between visiting a destination in December versus July can mean savings of 40% to 60% on accommodations alone. Shoulder seasons—the periods just before or after peak travel months—offer near-ideal weather with far fewer crowds and lower prices. A spring trip to a mountain town avoids both winter’s high ski-season rates and summer’s tourist surge. Similarly, coastal areas are often more pleasant and affordable in late September than in August, when demand peaks. These windows provide nearly identical experiences at a fraction of the cost.

Weekly timing also plays a crucial role. Many restaurants, attractions, and event venues operate on a demand curve that spikes on weekends. A wine-tasting tour booked for Saturday may cost 50% more than the same tour on Thursday. Theater performances and live music shows often have lower ticket prices for midweek shows, not because the performance is lesser, but because attendance is lower. By shifting social outings to weekdays, you access the same quality with better rates and shorter lines. Even dining out benefits from this pattern: some restaurants offer “happy hour” menus that last until closing, allowing full meals at reduced prices during less busy hours.

Additionally, booking timing can yield dramatic savings. Early-bird tickets for festivals, concerts, and conferences often cost 20% to 30% less than last-minute purchases. Airlines and hotels reward advance planning with lower rates, while last-minute deals can also emerge as providers seek to fill unused capacity. The key is flexibility. By keeping a list of desired experiences and monitoring pricing trends, you can act when conditions are optimal. This isn’t about waiting indefinitely—it’s about aligning desire with opportunity. When you replace impulsive booking with intentional timing, every dollar stretches further without diminishing the joy.

Unlocking Access, Not Just Discounts

I stopped looking for coupons and started seeking access. Membership programs, loyalty tiers, and community networks opened doors to early bookings, exclusive rates, and free upgrades. It wasn’t about spending more to save—it was about committing wisely. A modest annual fee for a curated experience club paid for itself in two uses. These aren’t gimmicks; they’re leverage points. When you align with the right platforms, you’re not a bargain hunter—you’re a strategic participant.

One of the most effective tools I discovered was premium membership networks that partner with local businesses to offer members-only benefits. These are not the flashy, high-pressure offers that flood inboxes, but carefully vetted programs with real value. For example, a regional cultural alliance offers members discounted or complimentary admission to museums, gardens, and historical sites across several states. An annual fee of $75 granted access to over 30 venues, each with individual admission prices ranging from $15 to $25. Using just five of them covered the cost, and visiting ten or more turned it into pure savings.

Loyalty programs through credit cards or travel platforms also provide tangible advantages. Points earned from everyday spending can be redeemed for concert tickets, dining certificates, or hotel stays. Unlike cash-back rewards, these points often have higher perceived value when used for experiences. A $200 concert ticket might cost only 20,000 points, equivalent to $200 in spending, but the emotional return on that ticket far exceeds a $200 statement credit. The key is consistency: using a single card for routine purchases and letting rewards accumulate over time creates a fund dedicated to experiences without additional spending.

Community-based memberships are another overlooked resource. Libraries, for instance, often lend not only books but museum passes, park entry permits, and even outdoor equipment. A local library in my area offers free reservations for state park cabins, normally priced at $120 per night. Schools and alumni associations sometimes provide access to travel discounts, event pre-sales, and dining perks. These are low-cost or no-cost entry points to premium experiences, available to those who know where to look. Access, not ownership, becomes the goal—and with it comes freedom from overpaying.

The Shared Economy Beyond Rides and Rooms

We know sharing cuts costs for transport and lodging, but it goes further. I joined local groups that pool resources for event tickets, group classes, and private tours. Splitting a wine-tasting tour with eight people dropped my cost by 70%. Shared experiences became cheaper and more social. This isn’t just cost efficiency—it’s redefining ownership. You don’t need to pay full price for something you use occasionally. Access beats ownership when it comes to experiences.

Group buying power is a quietly powerful tool. Many tour operators, cooking classes, and adventure outings offer tiered pricing based on group size. A private guided hike might cost $300 for one person, but only $60 per person when shared among six. By organizing or joining small collectives, individuals can access premium services at near-retail prices. I started a local “experience circle” with five other families, rotating responsibility for booking monthly outings. We’ve enjoyed hot air balloon rides, pottery workshops, and backstage theater tours at prices that would have been unthinkable individually.

Online platforms also facilitate shared access. Community forums and social media groups often coordinate bulk ticket purchases for concerts, sports events, and festivals. A recent example: a symphony performance offered group rates for parties of ten or more, reducing individual ticket costs by 45%. By connecting with others who share similar interests, we filled the requirement and enjoyed front-row seats at a fraction of face value. These arrangements don’t require formal organization—just communication and coordination.

Even dining experiences can be shared creatively. “Supper clubs” hosted in private homes allow members to take turns preparing multi-course meals for a small group. The cost of ingredients is divided, and the experience of cooking and dining together adds value beyond the food. One member with access to a vacation home initiated a weekend rotation where each family hosts a two-night stay for the group. Over a year, everyone gets a mini-vacation without the full cost of ownership or nightly rental fees. The shared economy, when applied thoughtfully, turns isolated expenses into collective value.

Reframing Value: What You’re Really Paying For

I analyzed dozens of past experiences: what felt worth it, what didn’t. Often, the highest-priced ones delivered the least joy. The $200 dinner? Overrated. The free neighborhood festival? Unforgettable. I began prioritizing emotional return over price tags. This led to a personal value filter: Does this align with my joy? Can I get similar energy elsewhere for less? Value isn’t fixed—it’s personal. When you define it clearly, overspending loses its grip.

Value perception is often influenced by external signals—brand names, celebrity endorsements, social media buzz—but these don’t guarantee satisfaction. A five-star restaurant with a long waitlist may serve technically perfect dishes, but if the atmosphere feels stiff or the service impersonal, the emotional payoff may be low. Conversely, a small-town farmers’ market with live music and homemade pie can generate lasting warmth and connection at minimal cost. The lesson isn’t that luxury is worthless, but that price and fulfillment are not always linked.

By creating a simple evaluation system, I began making more intentional choices. After each outing, I rated it on three dimensions: enjoyment, connection, and lasting impression. Over time, patterns emerged. Outdoor activities, community events, and learning-based experiences scored highest. Flashy dinners and crowded tourist spots often ranked lower. This data helped me redirect future spending toward what truly mattered. Instead of defaulting to “special occasion = expensive,” I started asking, “What kind of memory do I want to create?”

This shift also reduced decision fatigue. With a clear sense of personal value, I no longer felt pressured to chase trends or impress others. A picnic in the park with a good book and homemade lemonade became as valid a “premium experience” as a rooftop cocktail bar. The freedom to define value on my own terms removed the guilt of “not spending enough” and the regret of “overspending for little return.” Financial discipline and emotional fulfillment began to align, creating a sustainable rhythm of joy without excess cost.

Building a Low-Cost, High-Reward Experience Habit

Consistency beats intensity. Instead of one lavish trip a year, I spread smaller, smarter outings across months. A monthly museum visit with a student discount. A “local staycation” using free community passes. These micro-experiences added up to more joy than a single splurge. I built routines that made savings automatic—calendar alerts for off-peak deals, saved filters on booking sites, preset budget caps. Discipline became invisible because it was embedded.

One of the most effective habits I adopted was scheduling experiences in advance. By blocking out one weekend per month for a local adventure—a botanical garden visit, a scenic train ride, a historical walking tour—I ensured that enjoyment remained a regular part of life. These were not extravagant, but they were intentional. I paired each outing with a cost-saving strategy: using a senior or family membership, visiting on a free admission day, or combining it with a public transit discount. Over time, these small wins compounded into significant savings and a richer, more varied life.

Automation played a key role. I set up email alerts for price drops on event tickets and travel destinations. I saved search filters on booking platforms to instantly view off-peak rates. I used budgeting apps to allocate a fixed monthly amount for experiences, ensuring I never overspent. These tools removed the need for constant vigilance. Instead of reacting to deals, I built a system that delivered them. The result was not just financial control, but peace of mind.

Another powerful habit was reframing “splurges” as planned rewards. Rather than impulsively booking a concert after hearing about it, I added it to a “desire list” and waited for early-bird pricing or a member pre-sale. This delay often revealed better options or confirmed whether the experience was truly wanted. By treating each outing as a deliberate choice rather than a reaction, I increased satisfaction and reduced buyer’s remorse. The habit wasn’t about restriction—it was about elevation.

Staying Safe While Spending Smarter

Not all deals are safe. I learned to spot red flags: too-good-to-be-true offers, unsecured payment pages, pressure tactics. I stick to trusted platforms and always read the fine print. Risk control isn’t just about money—it’s about peace of mind. I also balance spending with savings goals, ensuring fun doesn’t compromise security. Smart experience spending isn’t reckless; it’s responsible freedom. You protect your future while enjoying today.

Security starts with source verification. I only book through official websites or reputable third-party platforms with clear customer support and refund policies. If a deal appears on an unfamiliar site with no reviews or contact information, I walk away. I avoid clicking on unsolicited offers in emails or social media, even if they appear to come from known brands. Phishing scams often mimic legitimate companies to steal personal data. A quick check of the URL or a call to customer service can prevent costly mistakes.

Reading the terms and conditions is non-negotiable. Many discounted tickets come with restrictions: non-refundable bookings, specific date requirements, or additional fees at checkout. A $50 concert ticket might become $85 after service charges and parking. A “free” resort stay might require a mandatory $150 activity fee. By reviewing all details upfront, I avoid surprises. I also pay with a credit card whenever possible, as it offers fraud protection and dispute resolution that debit cards lack.

Finally, I maintain a balanced financial picture. Every dollar spent on experiences is tracked against my overall budget. I ensure that savings, emergency funds, and retirement contributions are on track before allocating funds for leisure. This doesn’t mean delaying joy—it means funding it sustainably. By treating experience spending as part of a holistic financial plan, I enjoy more without anxiety. Safety and savings go hand in hand, creating a foundation for long-term fulfillment.

Wealth Is Measured in Moments, Not Just Money

True financial wisdom isn’t just growing wealth—it’s expanding life’s richness without overextending. By lowering the cost of experiences, I’ve gained more time, freedom, and joy. It’s not about cutting corners; it’s about optimizing access. Every dollar saved on inflated pricing is a dollar reclaimed for meaning. And that’s the real return: a life well-lived, well-budgeted, and fully felt. Financial control doesn’t limit experiences—it enhances them. When you spend with intention, every outing becomes more valuable. The goal isn’t to spend less, but to get more from what you spend. In the end, the richest life isn’t the one with the highest expenses, but the one with the deepest moments. And those, with a little strategy, are well within reach.